ad valorem tax florida statute

Under the provisions of Section 193621 Florida Statutes FS and Chapter 62-8 Florida Administrative Code some types of air or water pollution control equipment installed at any manufacturing or industrial plant may be eligible for decreased assessment value for ad valorem tax purposes. Ad valorem taxes and non-ad valorem assessments shall be assessed against the lots within a platted residential subdivision and not upon the subdivision property as a whole.

193011 any other applicable statutory.

. An elected board shall have the power to levy and assess an ad valorem tax on all the taxable property in the district to construct operate and maintain assessable improvements. Other provisions of this chapter notwithstanding pass-on charges may be passed on only within 1 year of the. The community land trust model envisions that the land will have one assessment and the improvements will have another.

TAX COLLECTIONS SALES AND LIENS. -12559 125016 - Ad valorem tax. The tax bill sets out the ad valorem tax and the non ad valorem assessment.

Body authorized by law to impose ad valorem taxes. State Codes and Statutes Statutes Florida TitleXI Chapter125 PARTI 125_016. The greater the value the higher the assessment.

Clink the link to read more. Taxes usually increase along with the assessments subject to certain exemptions. Even though the non ad valoremassessment is not a tax it is still included on the property tax bill.

INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION. Ad Valorem Taxes 1See Mikos v. 10 Mill means one onethousandth of a - United States dollar.

Section 125016 Florida Statutes is a general grant to counties of the authority to impose an ad valorem tax and provides in full. Annually an ad valorem tax of not exceeding 112 mills may be levied upon all property in the county which shall be levied and collected as. Without property taxes many of the services provided by.

1973632 Uniform method for the levy collection and enforcement of non-ad valorem assessments. 1 AD VALOREM TAXESAn elected board shall have the power to levy and assess an ad valorem tax on all the taxable property in the district to construct operate and maintain assessable improvements. See Florida Statutes 101.

An elected board may levy and assess ad valorem taxes on all taxable property in the district to construct operate and maintain district facilities and services to pay the principal of and interest on general obligation. Title XIV TAXATION AND FINANCE. 125016 Ad valorem tax.

194301 Challenge to ad valorem tax assessment 1 In any administrative or judicial action in which a taxpayer challenges an ad valorem tax assessment of value the property appraisers assessment is presumed correct if the appraiser proves by a preponderance of the evidence that the assessment was arrived at by complying with s. To pay the principal of and interest on any general obligation bonds of the district. 1 AD VALOREM TAXES.

Page 1 of 2. This article discusses a Florida property tax exemption case involving the Alachua County chamber of commerce. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

Annually an ad valorem tax of not exceeding 1½ mills may be levied upon all property in the county which shall be levied and collected as other county taxes are levied and collected. Our attorneys have a wealth of knowledge and experience in all aspects of property tax law and appeals to help taxpayers control costs. Law enforcement and public works.

193011 any other applicable statutory requirements relating to classified use values or. Ad valorem means based on value. Both the ad valorem tax and the non ad valorem assessment are due November 1st of each year in order to take advantage of the 4 discount not the focus of.

2021 Florida Statutes Back to Statute Search. Title XIV TAXATION AND FINANCE. 11 Personal property for the purposes of ad valorem taxation shall be divided into four categories as follows.

Millage may apply to a single levy of taxes or to the cumulative of all levies. To pay the principal of and interest on any general obligation. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption.

Levy allowed by a majority vote of the governing body is based on the rate of growth in per capita personal income in Florida. Collected annually Chapter 197 Florida Statutes - Tax Collections Sales and Liens. FL Stat 125016 2019 125016 Ad valorem taxAnnually an ad valorem tax of not exceeding 112 mills may be levied upon all property in the county.

2019 Florida Statutes Title XI - County Organization and Intergovernmental Relations Chapter 125 - County Government Part I - County. HOMES FOR THE AGED. If a Florida Property Tax Appraiser denies your longstanding ad valorem tax exemption.

A Levy means the imposition of a non-ad valorem assessment stated in terms of rates against all appropriately located property by a. If a county property appraiser is in doubt whether a taxpayer is entitled. Rennert Vogel Mandler Rodriguez has one of the largest and most successful ad valorem taxation departments in Florida.

The term non-ad valorem assessments has the same meaning as provided in s. If the property appraiser finds that the applicant is. Ad valorem taxes may be increased at a greater rate only with a super majority or unanimous vote of the local government.

An ad valorem tax or non-ad valorem assessment including a tax. Property tax can be one of the biggest single expense items for commercial properties. Florida Tax Law Blog.

Such ad valorem taxes non-ad valorem assessments and utility charges shall be a part of the lot rental amount as defined by this chapter. Kings Gate Club Inc 426 So2d 74 Fla2nd DCA 1983. 1 AD VALOREM TAXES.

Of the ad valorem taxes paid for the newly acquired property if he or she applies for and receives an exemption under this section for the newly acquired property in the next tax year. 1 As used in this section. Accordingly in light of the plain language of section 19619955 Florida Statutes I am of the opinion that a city may grant an economic development ad valorem tax exemption pursuant to section 1961995 Florida Statutes for a period of up to 10 years even though the term of the exemption extends beyond the time the city is authorized to.

And to provide for any. 1 In any administrative or judicial action in which a taxpayer challenges an ad valorem tax assessment of value the property appraisers assessment is presumed correct if the appraiser proves by a preponderance of the evidence that the assessment was arrived at by complying with s. 2021 Florida Statutes Back to Statute Search.

Impact fees and user charges. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect. The 2021 Florida Statutes.

SECTION SIX - AD VALOREMY TAXES IN FLORIDA There are several questions to be addressed in regard to ad valorem taxation in Florida.

Florida Real Estate Taxes What You Need To Know

Study Guide For Real Estate Exam Realtor Study And Terms Etsy In 2022 Real Estate Exam Study Guide Exam

When It Comes To Estate Planning It Pays To Consider Each And Every Option For Protecting Your Legacy One Of The Be Estate Planning Life Estate Things To Come

Terms To Know Before You Start Your Home Search Real Estate Terms Home Buying Process Real Esate

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

Form Dr 462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

Don T Forget To File Your Homestead Exemption Your Application Must Be Applied For On Or Before April 29 2018 Real Estate Investing Homesteading Real Estate

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com

Fl Veterans Property Tax Exemptions You Need To Read This Dor Myflorida Com Dor Property Brochures Pt109 Pdf Property Brochures Brochure Property Tax

Tax Certificate And Tax Deed Sales Pinellas County Tax

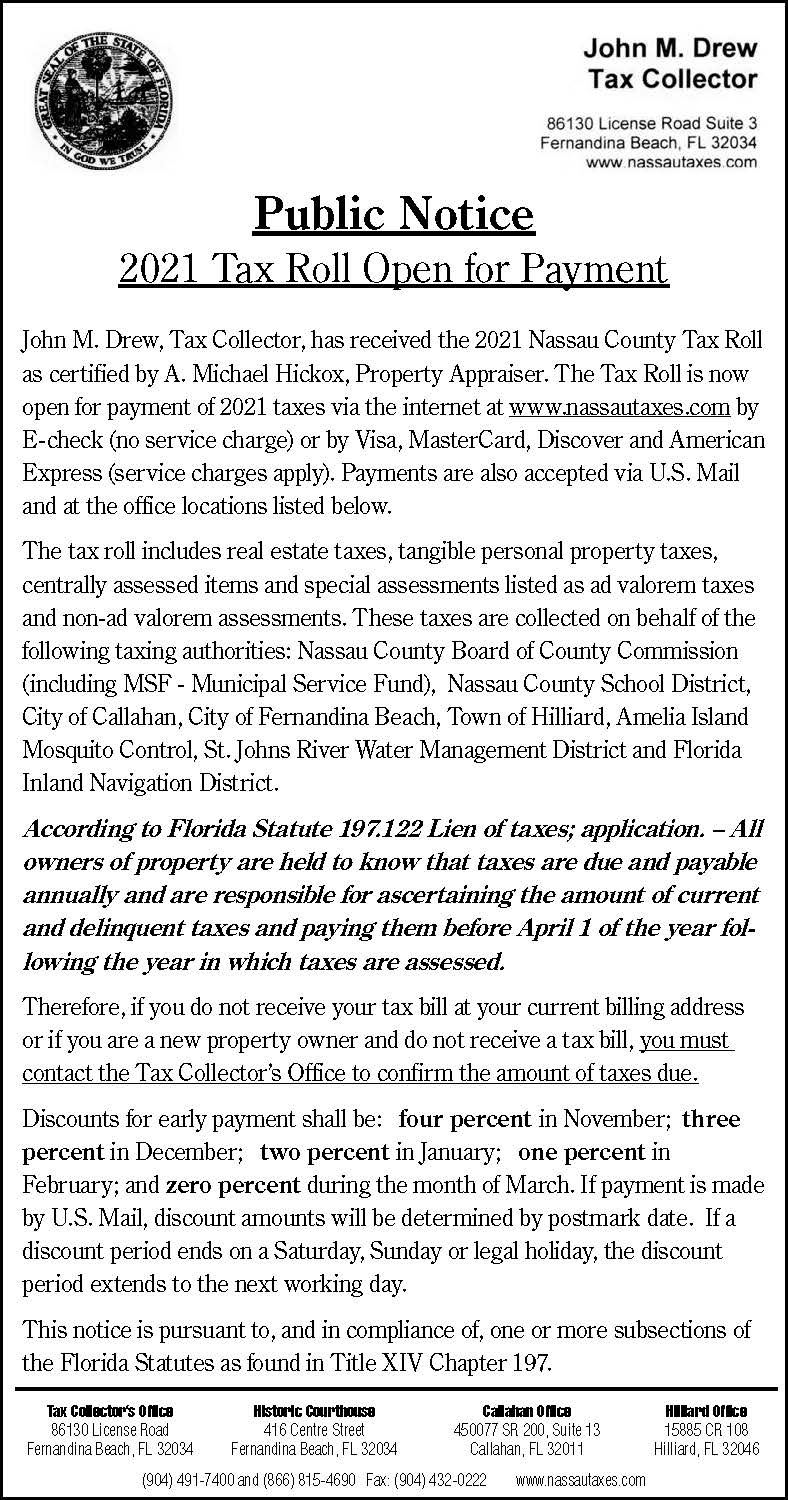

Public Notice 2021 Tax Roll Open For Payment News Leader Fernandina Beach Florida